ARM-twisting "A Degree of Practical Wisdom": A one-year readjustment of legal education's debt-based stress test

Roughly a year ago, I posted what was then the preliminary version of A Degree of Practical Wisdom: The Ratio of Educational Debt to Income as a Basic Measurement of Law School Graduates’ Economic Viability, 38 Wm. Mitchell L. Rev. 1185 (2012) (available online at http://ssrn.com/abstract=1967266 or http://bit.ly/DegreePracticalWisdom). After a year of summarizing and presenting A Degree of Practical Wisdom before multiple audiences and subjecting its model to the test of actual, real-world applications, I have decided to propose some modifications in my model. Think of it as the annual ARM-twisting that accompanies any adjustable-rate mortgage.

A Degree of Practical Wisdom argued that law schools should subject themselves to one form of stress-testing: measuring the ratio of their students’ educational debt to those students’ post-graduation incomes. My original analysis used mortgage lending policies, as developed by private lenders and by the Federal Home Administration, to identify three ratios of monthly debt service to monthly gross income:

- Marginal: 0.12

- Adequate: 0.08

- Good: 0.04

On the assumption that the most affordable loan terms allow law school graduates to amortize their loans at 6 percent interest over 25 years, the foregoing versions of the “educational back-end ratio” correspond to the following ratios of (law school) educational debt to (gross) annual income:

- Good: 0.5

- Adequate: 1.0

- Marginal: 1.5

In the year since I first posted A Degree of Practical Wisdom and invited commentary on it, I have had the benefit of "field testing." Drawing upon efforts of my own and by others to apply my stress tests, I now propose a modest readjustment of my approach for assessing recent law school graduates' economic viability. I will restate ratios of debt to income as their reciprocals — as ratios of income to debt — in order to focus attention on the different salary outcomes achieved by recent law school graduates. I will also relax the stringency of my original stress tests. It turns out that almost no law school graduates begin with an annual income double their level of law school debt. A 2:1 ratio of annual gross income to law school debt is the reciprocal of the “good” 0.5 ratio of debt to income. I will readjust this highest level of economic attainment to a ratio of 3:2. I will also rename the three levels of economic attainment:

- Excellent: A 3:2 ratio of annual gross income to total law school debt

- Healthy: A 1:1 ratio

- Viable: A 2:3 ratio

Multiplying by 1.5 (or 3:2) closes the gap between the viable and healthy levels, or the healthy and excellent levels. Relative to my original level of "good" economic performance, the new "excellent" category actually reflects a slightly higher debt burden. The reciprocal of an "excellent" 3:2 ratio of annual income to total debt means that the ratio of law school debt to annual income is 2:3. The corresponding ratio of law school debt service to gross annual income is approximately 5.33 percent.

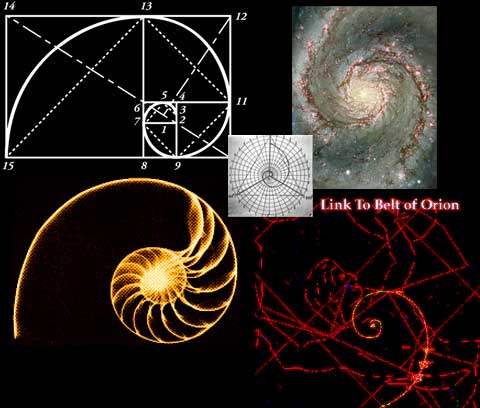

The new ratios sacrifice some of my original model's elegance for real-world utility in a legal services market where very, very few entrants can expect to win an annual salary whose face value is double their level of law school debt. Then again, the 1.5 (or 3:2) ratio that describes the transition between each of the new categories — from viable to healthy and again from healthy to excellent — has an elegance all of its own. A 1.5 ratio is reasonably close to (1 + √5)/2 (approximately 1.618) or φ, the celebrated golden ratio of Pythagorean mathematics. In an age when grades and tuition rates have inflated faster than salaries and the gross domestic product, we may take solace in the legal academy's own version of the "Aurea mediocritas."

Editor's note: For the images in this post, I tip my hat to Scottish artist Judith I. Bridgland.

0 Comments:

Post a Comment

<< Home